On April 30, 2025, the Supreme Court of India issued a landmark judgment (Pragya Prasun & Ors. vs. Union of India & Ors.) emphasizing that digital KYC systems must be accessible to persons with disabilities, including acid attack survivors and the visually impaired. The Court declared digital access a fundamental right under Article 21 of the Indian Constitution, and mandated RBI to issue guidelines enabling alternative methods of verifying liveness beyond blinking or facial gestures.

What This Means for Liveness Detection in KYC

Today, most banks, fintech apps, and verification providers use active liveness detection methods — asking users to blink, smile, or turn their heads. While these seem harmless to most, they pose serious challenges to:

Acid attack survivors

Blind or visually impaired users

Persons with neuromuscular disabilities

Senior citizens and rural populations with limited digital literacy

This ruling mandates an urgent shift: KYC systems must become inclusive, accessible, and regulation-compliant.

SpoofSense Liveness Detection: Built for Accessibility and Compliance

At SpoofSense.ai, we've been ahead of the curve. Our facial liveness detection system is:

Single-frame passive: Requires only one image; no gestures or movement

iBeta Level-2 compliant: Internationally recognized anti-spoofing benchmark

Hardware-agnostic: Works on basic smartphones, even in low bandwidth areas

That means our technology is already suited for the kind of accessible digital KYC the Supreme Court now requires.

Why SpoofSense is the Right Choice for Fintechs, Banks & KYC Vendors

If you're a regulated entity or a digital service provider, here's what you need to ensure:

Your KYC and onboarding processes do not discriminate based on physical or sensory ability

You're compliant with the upcoming RBI circular on inclusive digital KYC

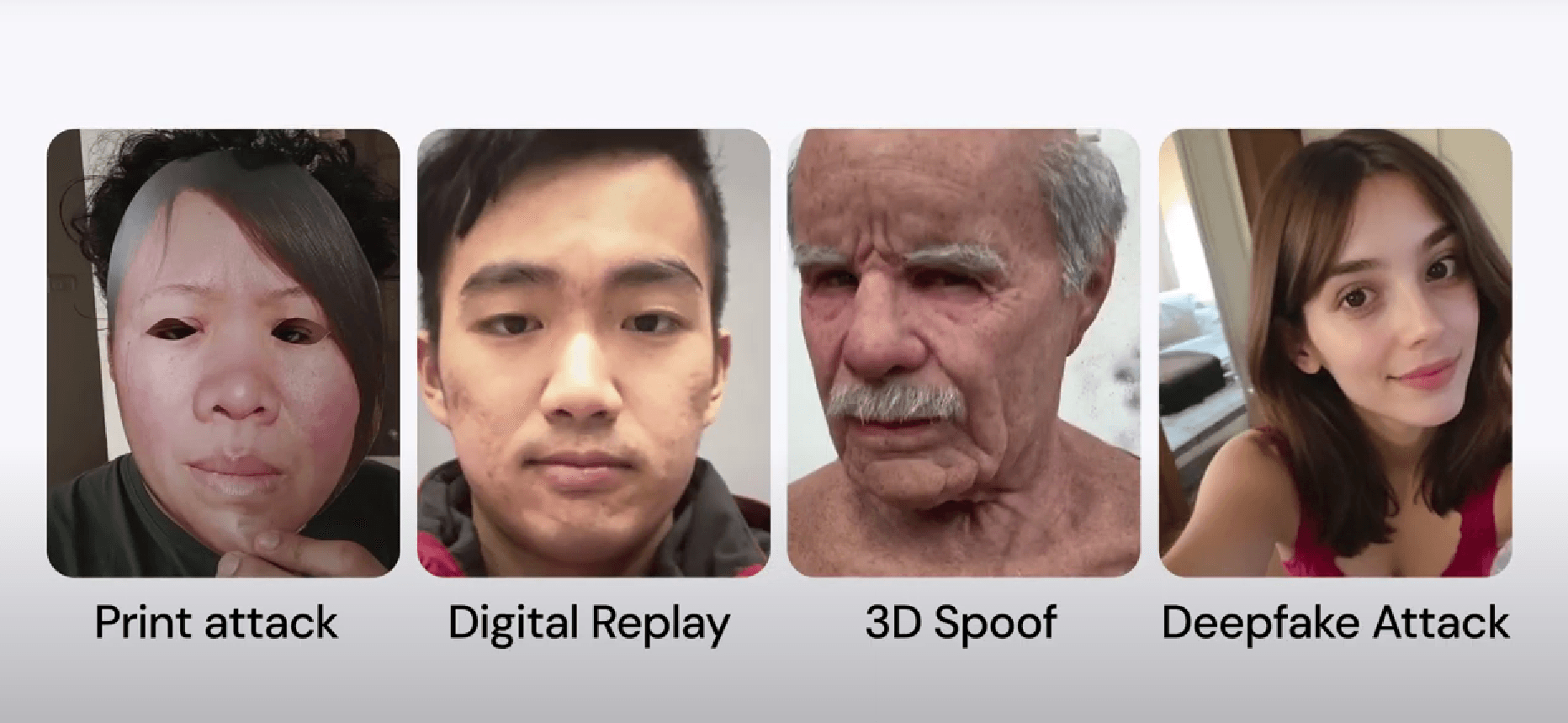

Your liveness detection tech is future-ready and deepfake-proof

SpoofSense checks all these boxes — today.

Key Features That Drive Accessibility

No blinking or smiling needed: Just one selfie is enough

High accuracy on occluded or non-standard faces

Zero user effort: Great for users with motor impairments

Easy API integration: Plug-and-play setup for fast adoption

Real Impact: Compliance + Inclusion

We recently enabled one of India's top identity verification providers to process over 10 million+ digital KYCs — detecting over 45,000 spoof attempts, including passive digital replays, face masks, etc.

We believe security shouldn't come at the cost of inclusion. This Supreme Court ruling validates that belief and pushes the entire industry forward.

Next Steps for Your Business

Evaluate your current liveness detection system — is it inclusive?

Contact us for a free audit or pilot integration

Stay compliant with upcoming RBI guidelines and make your platform accessible to all

Final Word

The future of KYC is not just digital — it’s inclusive, secure, and deepfake-resistant. SpoofSense.ai is proud to lead that transformation.

🔍 Looking to make your Face Liveness process compliant and inclusive?

📩 Reach out to us at kartikeya@spoofsense.com or schedule a demo today.

📈 Boost your compliance, reduce fraud, and serve every user — equally.