As digital transformation reshapes financial services, Video KYC (Know Your Customer) has become the preferred method for remote identity verification. What once required physical presence and paper-based processes can now be completed from a smartphone in under two minutes. From opening bank accounts and applying for loans to investing in mutual funds or accessing financial inclusion programs, users demand speed, convenience, and trust.

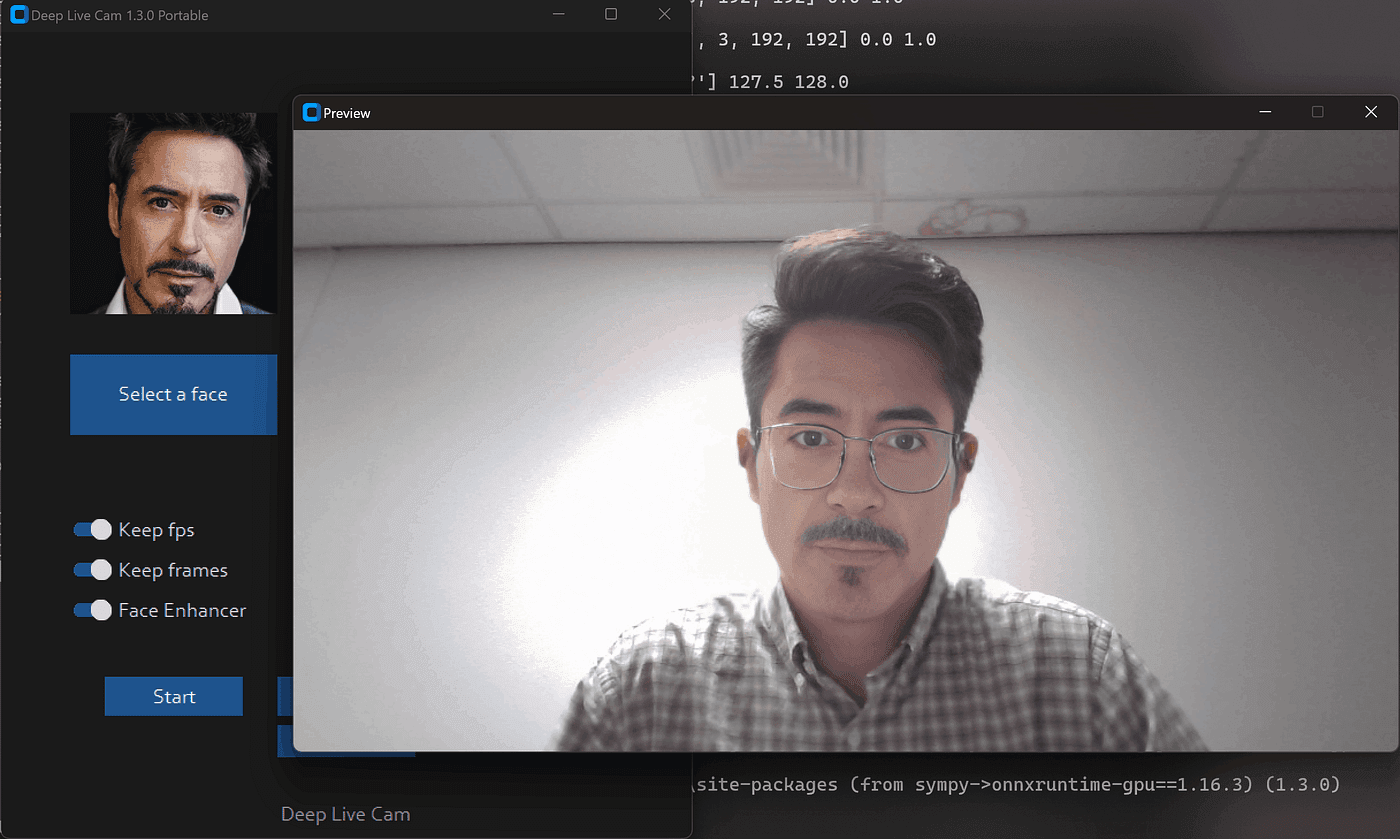

However, this shift has introduced an equally potent challenge: identity fraud driven by AI-generated content such as deepfakes and real-time face swaps.

Evolving Attack Methods in Digital Onboarding

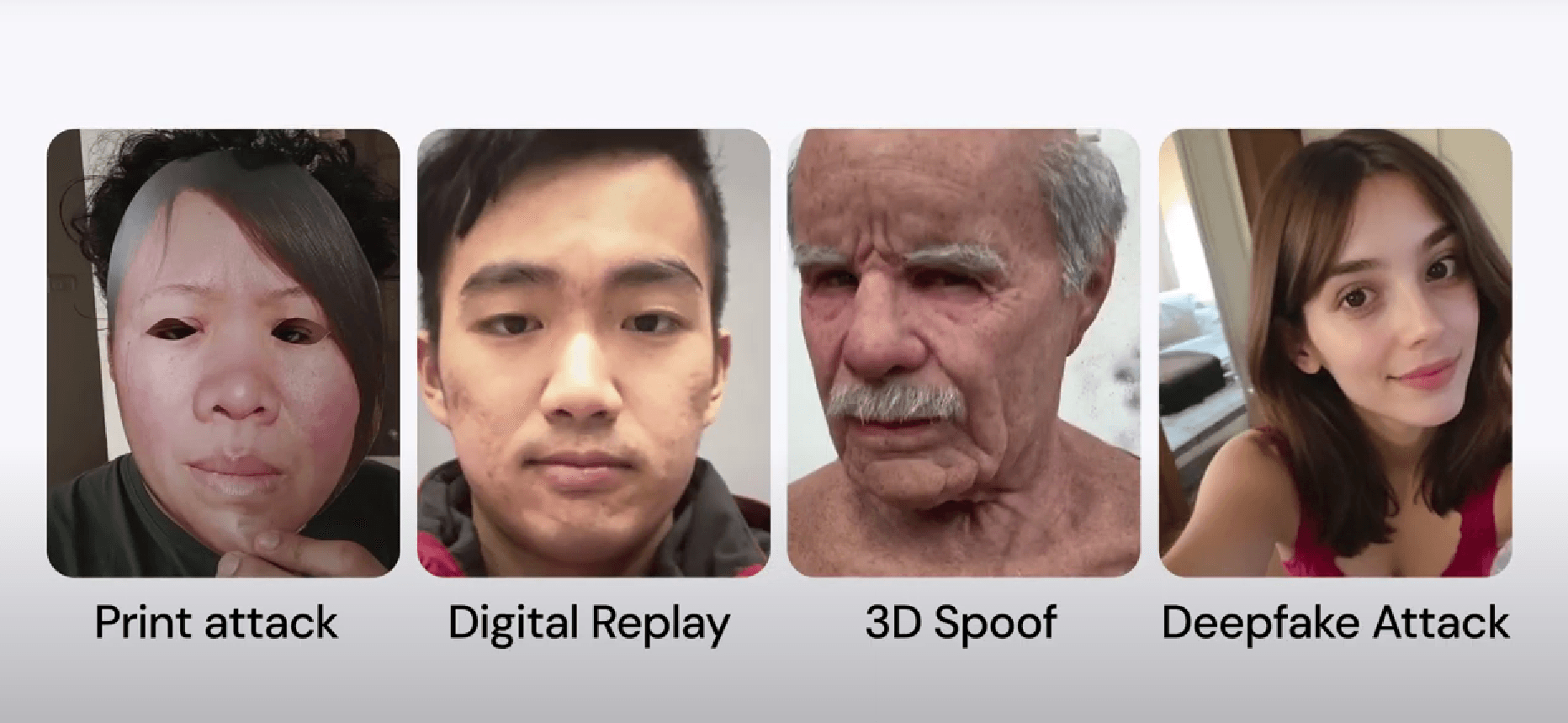

Fraudsters are no longer limited to basic image-based attacks. Today’s identity frauds exploit powerful tools such as:

High-resolution printed or digital photos

Pre-recorded videos showing facial gestures

Hyper-realistic 3D silicone masks

Deepfake-generated video substitutions

Real-time face swap apps

These tactics can easily bypass traditional facial recognition and standard liveness detection systems. In high-stakes industries like finance and lending, these evolving threats demand a more comprehensive solution. That solution is a dual-layered system combining passive liveness detection with robust deepfake and face swap detection — the cornerstone of SpoofSense Face.

The Growing Risk Surface in Video KYC

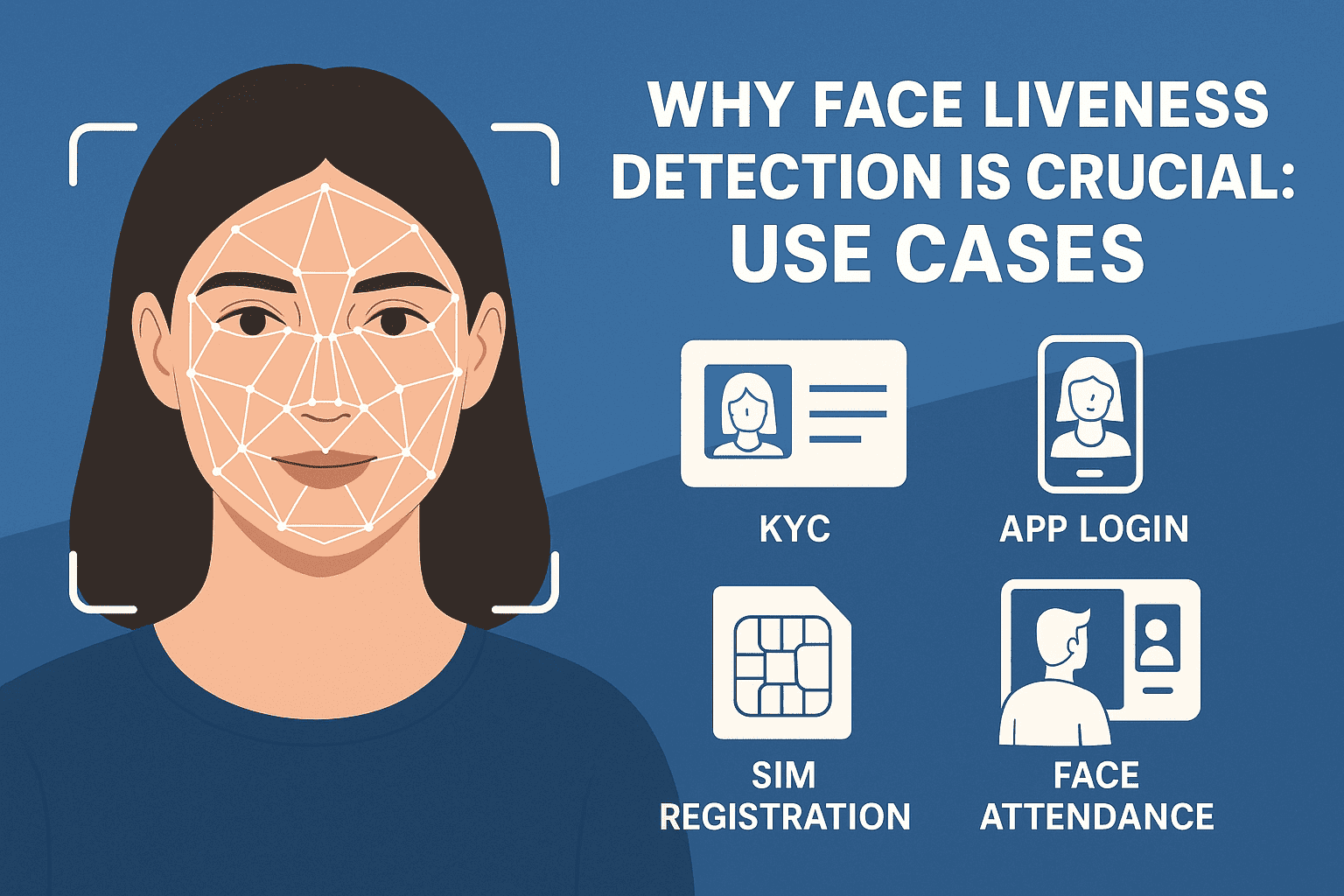

Video KYC is used widely across:

Digital banks and fintech onboarding

Credit underwriting and disbursement

Insurance and policy enrollment

Investment account verification

Payment apps and UPI services

Its benefits — speed, scalability, and paperless interaction — also create new risks. Attackers increasingly use:

Static image and video replays

Mask-based impersonations

Software-level injection attacks

Real-time synthetic overlays

Open-source AI tools such as DeepFaceLab, FaceSwap, and even social media filters are now weaponized to execute these attacks. Some fraud rings now offer identity spoofing as a service.

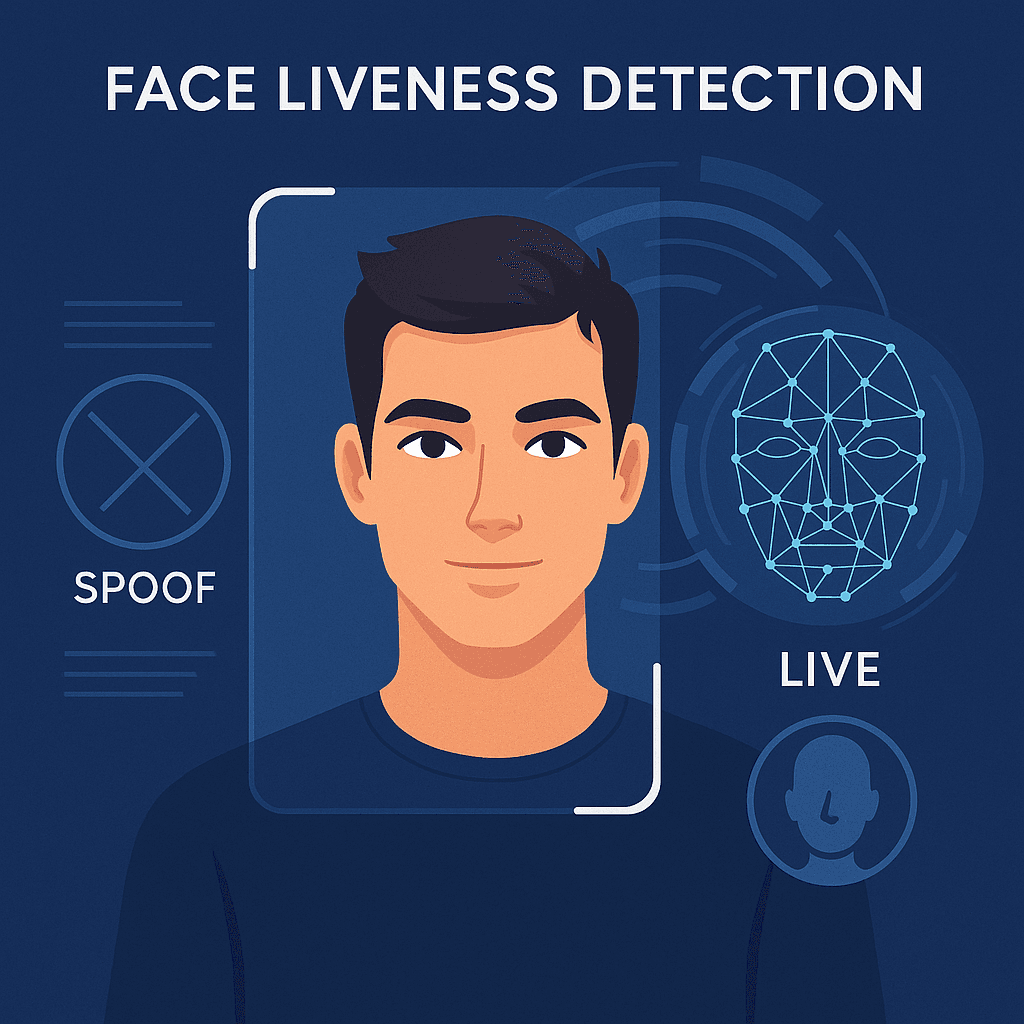

Passive Liveness Detection: Reducing Friction, Increasing Security

Traditional active liveness systems ask users to blink, smile, or turn their head. This introduces friction, raises accessibility issues, and is vulnerable to replay attacks.

Passive liveness detection works differently. It analyzes visual and temporal cues silently in the background, such as:

Skin texture and fine-grain facial details

Natural lighting reflections

Micro-movements and parallax shifts

Inconsistencies across video frames

Key benefits:

Improved user experience

Higher onboarding success rate

Compatibility with low-end devices and poor networks

Faster authentication (<1 second)

Yet even passive liveness struggles to detect synthetic media unless paired with advanced forgery detection.

Deepfakes and Face Swaps: The Unseen Challenge

Deepfakes are AI-generated videos that convincingly mimic someone’s identity. When combined with real-time face swap technology, attackers can impersonate a legitimate user with uncanny realism — matching expressions, blink rates, and lip movements.

In a Video KYC context, these synthetic threats can:

Pass both passive and active liveness checks

Evade biometric systems entirely

Fool both automated and manual review workflows

Most KYC systems are not equipped to detect such attacks, leaving them vulnerable to high-confidence fraud.

SpoofSense Face Plus: A Holistic Defense Against AI Fraud

SpoofSense Face Plus is a comprehensive solution combining:

✅ Passive Liveness Detection — No gestures needed; seamless UX

✅ iBeta Level-2 Certification — Globally recognized performance validation

✅ Deepfake & Face Swap Detection — AI models trained on adversarial and real-world forgery datasets

✅ Injection Attack Prevention — Verifies authenticity of camera source

✅ <1s Response Time — Suitable for real-time onboarding environments

Our system analyzes:

Spatial distortions around facial features

Temporal inconsistencies in expressions

Lighting anomalies in synthetic frames

Morphing artifacts invisible to the human eye

Regulatory Pressure and Market Need

India’s RBI, SEBI, and IRDAI increasingly mandate strong, tamper-resistant identity checks. While passive liveness meets compliance minimums, it may not be sufficient as deepfake risks escalate.

Recent data underscores the need:

930% rise in deepfake frauds (2022–2024, Sensity AI)

₹1,200+ crore in fraud losses tied to KYC gaps in 2023

Over 17,000 flagged KYC cases due to spoofing or manipulation

SpoofSense Face+ helps:

Preempt high-impact fraud

Meet evolving compliance standards

Build trust in automated onboarding

Built for India, Scalable Worldwide

SpoofSense Face+ is optimized for real-world conditions:

Runs on low-resolution cameras (≥2MP)

Operates under 2G/3G networks

Integrates easily via API, SDK, or cloud endpoints

Deploy it in:

Lending and NBFC apps

Insurance and investment flows

Citizen service portals

Large enterprise KYC stacks

KYC Needs to Evolve with the Threats

It’s no longer enough to detect whether a face is “live.”

You must also ensure that face hasn’t been synthetically generated or tampered with.

SpoofSense Face Plus delivers the protection fintechs and banks need:

Passive Liveness

Deepfake and Face Swap Detection

Injection Protection

Seamless, fast user experience

✅ Secure

✅ Compliant

✅ Scalable

👉 Book a demo to experience SpoofSense Face Plus in action.