As digital identity becomes the backbone of secure authentication and onboarding across industries, face liveness detection has emerged as a pivotal layer of defense against modern identity fraud. From digital banking and telecom to education and workforce management, verifying not only who a user is but whether they are physically present is now an essential capability.

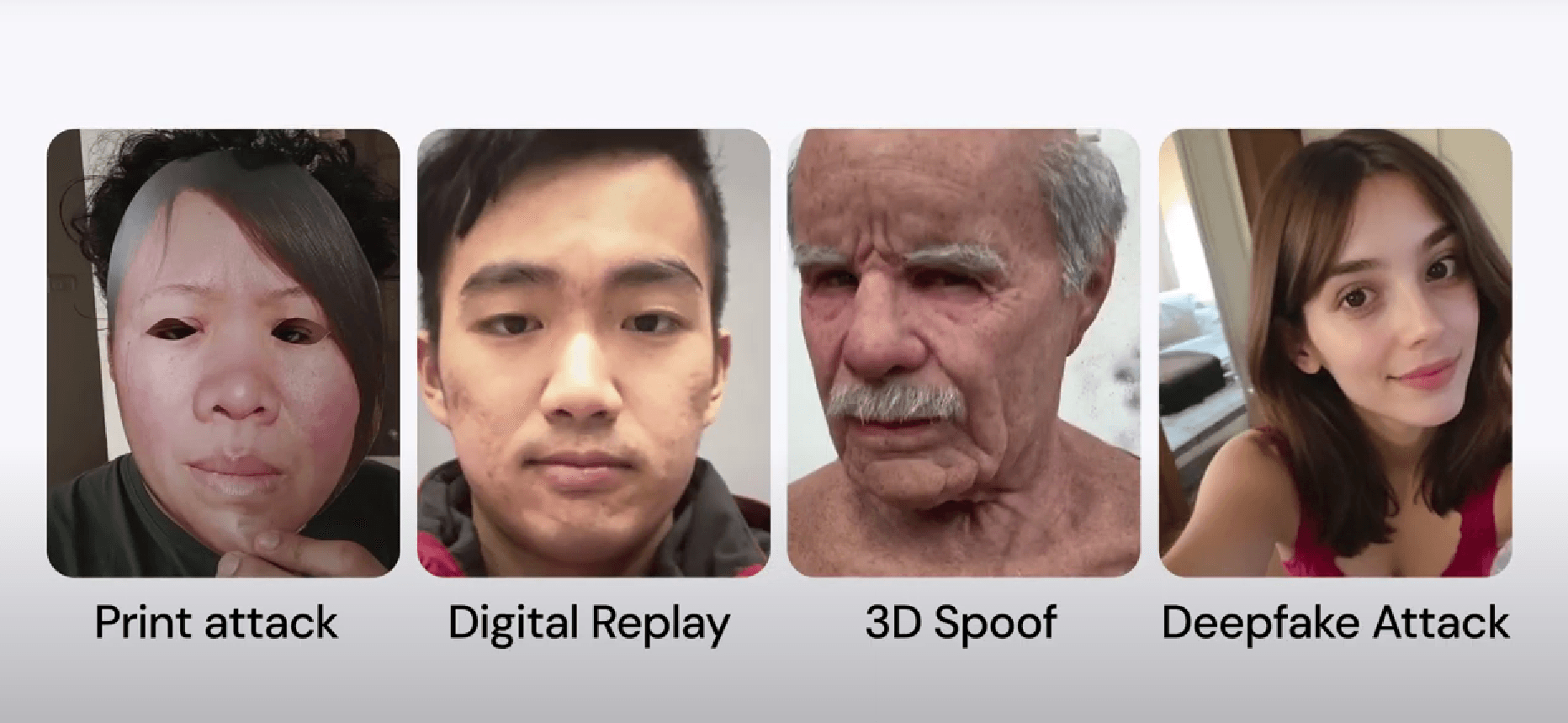

While traditional facial recognition systems can match identities based on static features, they are susceptible to spoofing attacks such as printed photographs, replayed videos, deepfakes, 3D silicone masks, and camera feed injections. These sophisticated forms of fraud allow unauthorized individuals to impersonate others and bypass security controls.

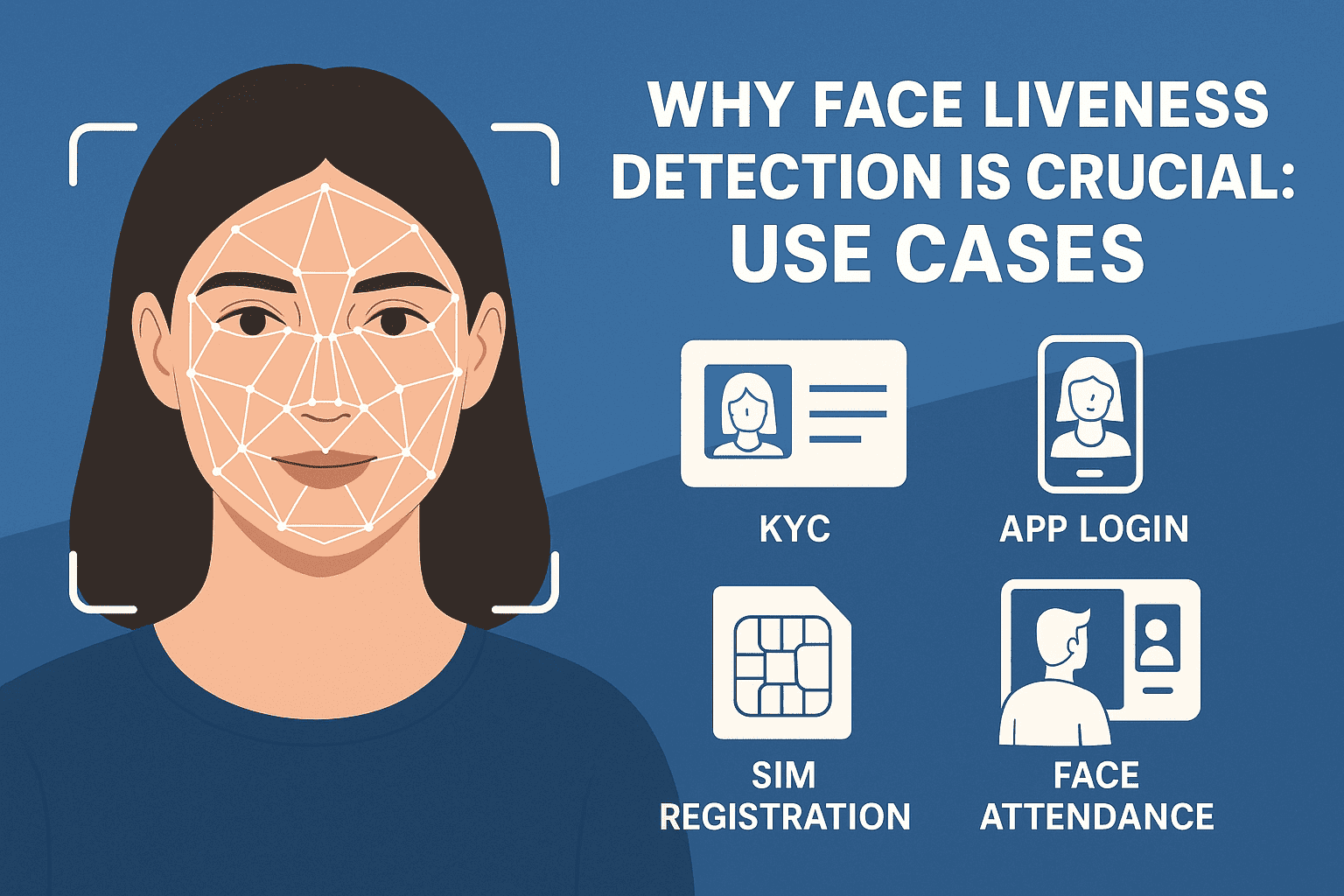

This article highlights 9 critical use cases where face liveness detection is essential, demonstrating how it safeguards digital processes from deception and builds user trust in high-stakes environments.

1. Biometric Face Attendance Systems (Preventing Buddy Punching)

Context: Corporates, educational institutions, and government departments use biometric systems to track employee and student attendance.

Fraud Vector: Individuals attempt buddy punching by using another person's printed photo or video to record attendance in their absence.

Why Liveness Detection Matters:

Detects and blocks static image or video submissions

Ensures only physically present users are authenticated

Prevents payroll fraud and enforces compliance in regulated industries

Example: A manufacturing firm integrates passive liveness into its attendance system, reducing time fraud and ensuring accurate workforce tracking even during unattended night shifts.

2. Digital KYC and Customer Onboarding (Fintech, Banks, NBFCs)

Context: Financial services rely on digital Know Your Customer (KYC) workflows to verify user identities remotely.

Fraud Vector: Fraudsters upload stolen documents, selfies, or replayed videos to create fake financial accounts.

Why Liveness Detection Matters:

Filters out spoofed KYC attempts using passive verification

Strengthens compliance with RBI, SEBI, and AML guidelines

Enhances fraud detection without increasing onboarding friction

Example: A lending platform integrates SpoofSense.ai’s passive liveness check to flag and reject fake identity submissions during selfie-based KYC.

3. Video KYC for Financial Product Verification

Context: Video KYC is a mandated identity verification method for onboarding customers to products like loans, mutual funds, and insurance.

Fraud Vector: Attackers inject deepfakes or AI-generated face swaps into video calls to impersonate real users.

Why Liveness Detection Matters:

Detects face manipulations in real time

Verifies authenticity of live camera feeds

Creates audit-ready trails for regulators and compliance teams

Example: An NBFC uses dual-layer verification with passive liveness and deepfake detection to prevent synthetic identities from completing video KYC.

4. Facial Authentication for App Login and Secure Transactions

Context: Mobile apps in finance, health, and enterprise use face recognition for user login and transaction authentication.

Fraud Vector: Adversaries use stolen selfies, social media photos, or videos to impersonate legitimate users.

Why Liveness Detection Matters:

Adds real-time validation to biometric authentication

Prevents account takeovers using spoofed imagery

Replaces or supplements OTP, PIN, and password systems

Example: A digital bank mandates liveness-based facial login for all high-value transfers, offering both convenience and fraud resistance.

5. SIM Card Registration and eKYC (Telecom Industry)

Context: Telecom providers register users through face-based eKYC, often linked with Aadhaar or government ID.

Fraud Vector: Criminals register SIM cards using spoofed identities or stolen ID photos.

Why Liveness Detection Matters:

Ensures only present, real users are issued SIM cards

Mitigates risks of SIM swap attacks and fake registrations

Supports regulatory enforcement (TRAI, DoT)

Example: A telecom operator integrates liveness detection into its mobile KYC app to catch identity spoofing attempts at retail outlets.

6. e-Governance, Voting, and Welfare Schemes

Context: Governments use digital ID verification for public benefit distribution, online voting, and citizen authentication.

Fraud Vector: Relatives or middlemen impersonate rightful beneficiaries using static images or old video clips.

Why Liveness Detection Matters:

Ensures only eligible, live users access entitlements

Secures online voting and public service portals

Enables mobile-first identity verification at scale

Example: A direct benefit transfer (DBT) portal uses passive liveness to prevent fraudulent withdrawals and protect government subsidies.

7. Remote Exam Proctoring and eLearning Identity Checks

Context: Online education platforms authenticate student identity before and during assessments.

Fraud Vector: Proxy candidates use spoofed video or facial overlays to impersonate enrolled students.

Why Liveness Detection Matters:

Authenticates the correct student at login and during exams

Preserves academic integrity in high-stakes settings

Enables automated, scalable proctoring

Example: An online testing platform uses timed selfie prompts with passive liveness to continuously verify the presence of the correct student.

8. Driver, Delivery Agent, and Field Worker Identity Checks

Context: On-demand platforms use facial verification to ensure only verified workers operate under their accounts.

Fraud Vector: Gig workers share accounts or bypass verification using spoofed photos.

Why Liveness Detection Matters:

Prevents account misuse and improves platform accountability

Enhances customer safety and regulatory trust

Supports on-demand authentication in low-connectivity zones

Example: A delivery app requires periodic selfie prompts with liveness detection to validate driver identity throughout their shift.

9. Social Media, Dating Apps, and Content Platforms

Context: Social and creator platforms require user verification to build trust and reduce impersonation.

Fraud Vector: Fake accounts, bots, and catfish profiles use stolen or generated images to deceive users.

Why Liveness Detection Matters:

Prevents creation of fake or bot-driven accounts

Verifies creators and high-risk users before monetization

Builds user confidence in platform authenticity

Example: A dating app verifies new users using a passive liveness check to issue a “Verified Human” badge, improving user safety.

Face Liveness Detection Is the New Standard for Digital Trust

In an era where face-based identity is used to grant access to finances, education, mobility, and government services, validating presence is just as important as validating identity. Face liveness detection serves as the invisible but essential gatekeeper that confirms users are truly who they appear to be — and that they are actually present.

SpoofSense.ai provides:

Passive, gesture-free liveness detection

Deepfake and face swap detection

Injection attack protection and audit compliance

✅ Scalable to millions of users

✅ Built for real-world fraud environments

✅ Easy to deploy in apps, devices, or APIs

👉 Book a demo and discover how face liveness can secure your platform from the very first frame.